On June 4 a link to survey on the proposed Community Safety Payroll Tax was released via NLC list for all neighborhoods and posted in the Jefferson Westside Neighbors June eNews, on the JWN Facebook page and website, and our local NextDoor page. The survey closed at 11:45 June 9. A total of 185 people filled out the survey (31 Jefferson Westside Neighbors).

The purpose of this survey is to provide another avenue of feedback that is equal to email/letters, personal meetings, and public testimony directed to city council and is not designed or intended to make statistic inferences about public opinion as a whole. This survey was designed as a public service courtesy of Jefferson Westside Neighbors and administered on a Survey Monkey account provided by Human Rights and Neighborhood (HRNI) Involvement for use by all neighborhood associations.

The Survey Introduction and Instructions (see attached) provided context and an overview of the issue taken from various City of Eugene website and Register Guard articles and editorials.

The survey asked respondents neighborhood and then:

- Based on your personal experience, do you believe that the Eugene Police Department has the officers and resources needed to maintain public safety? (Y/N/other)

- To what degree do you support/oppose a tax for employees making more than minimum wage of 0.4% of their gross annual wages, while employers and minimum-wage workers would pay 0.2% to pay for increased public safety spending? (Likert Scale from Strongly Support to strongly Oppose).

- Open comment box.

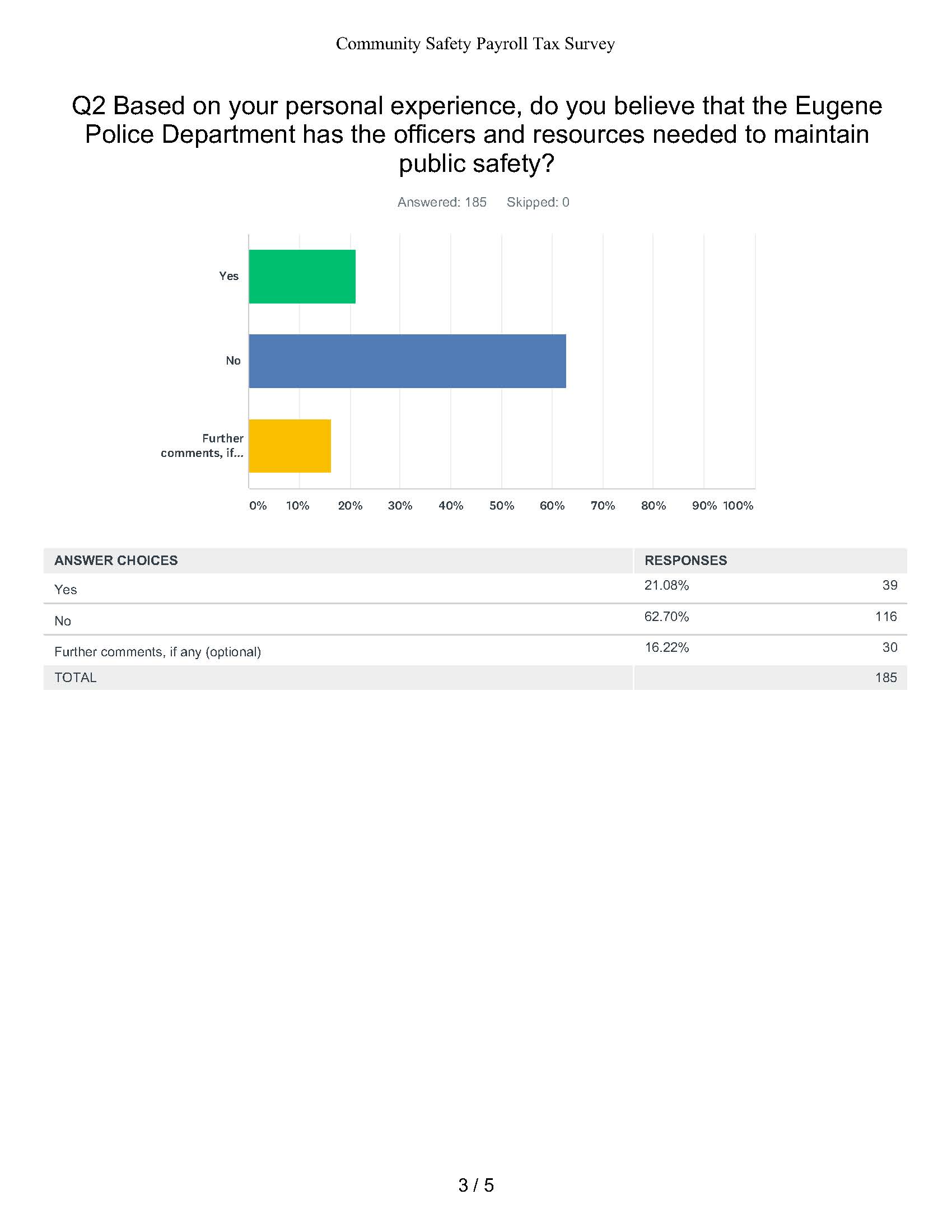

Q2: Based on your personal experience, do you believe that the Eugene Police Department has the officers and resources needed to maintain public safety?

61.70% of respondents reported they do not think the Eugene Police Department has enough resources to maintain public safety.

21.80% believe the Eugene Police Department has enough resources to maintain public safety.

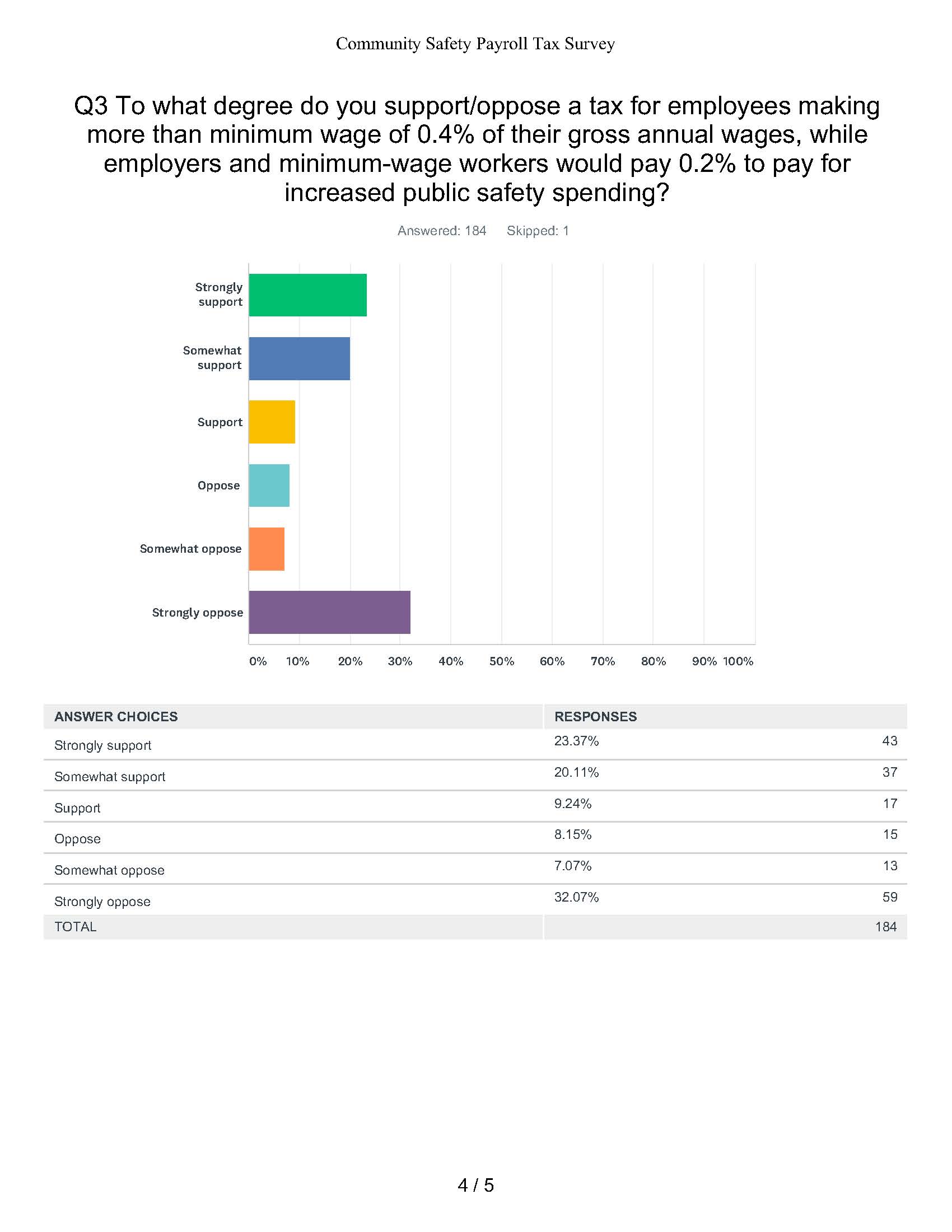

Q3: To what degree do you support/oppose a tax for employees making more than minimum wage of 0.4% of their gross annual wages, while employers and minimum-wage workers would pay 0.2% to pay for increased public safety spending?

A bare majority (52.72%) support the tax with 47.28% opposed. The major difference is in the strength of sentiments. A majority of those opposed strongly oppose the measure (32.07%), while support is more qualified, with 23.37% strongly supporting and 20.11% somewhat supporting.

A full copy of all written comments by survey respondents is available on request.

A full copy of all written comments by survey respondents is available on request.