Neighborhood Survey: LEC Conestoga Hut Pilot

Jefferson Westside Neighborhood Survey

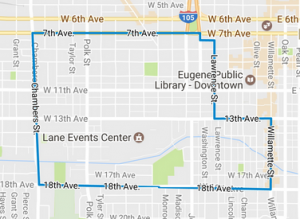

This survey is for JWN residents (renters and owners), property owners, business owner/managers, or non-profit directors located within the JWN .

There is a proposed pilot project to site 3 Conestoga huts (+ porta-potty and trash bin) on Lane Events Center property near W. 13th and Tyler. Community Supported Shelters would actively manage the site. For more information and to take the survey (closes October 31), go to:

https://www.surveymonkey.com/r/9FK7Q7N.

You may also contact the JWN directly at jwneugene@gmail.com.